HIGHLIGHTS OF MAJOR POINTS / CHANGES RECOMMENDED (47th GST Council Meeting 28 & 29 JUNE 2022)

- Refund NOT ALLOWED (COAL & EDIBLE OIL) under inverted duty structure

- Electric Vehicles (EV) (With or without battery) will be charged at 5% GST

- Renting the Motor vehicles (passenger) to Body Corporate will be covered under RCM

- Pre-Packaged & Pre-Labelled products also taxable under GST (Branded & Non branded both)

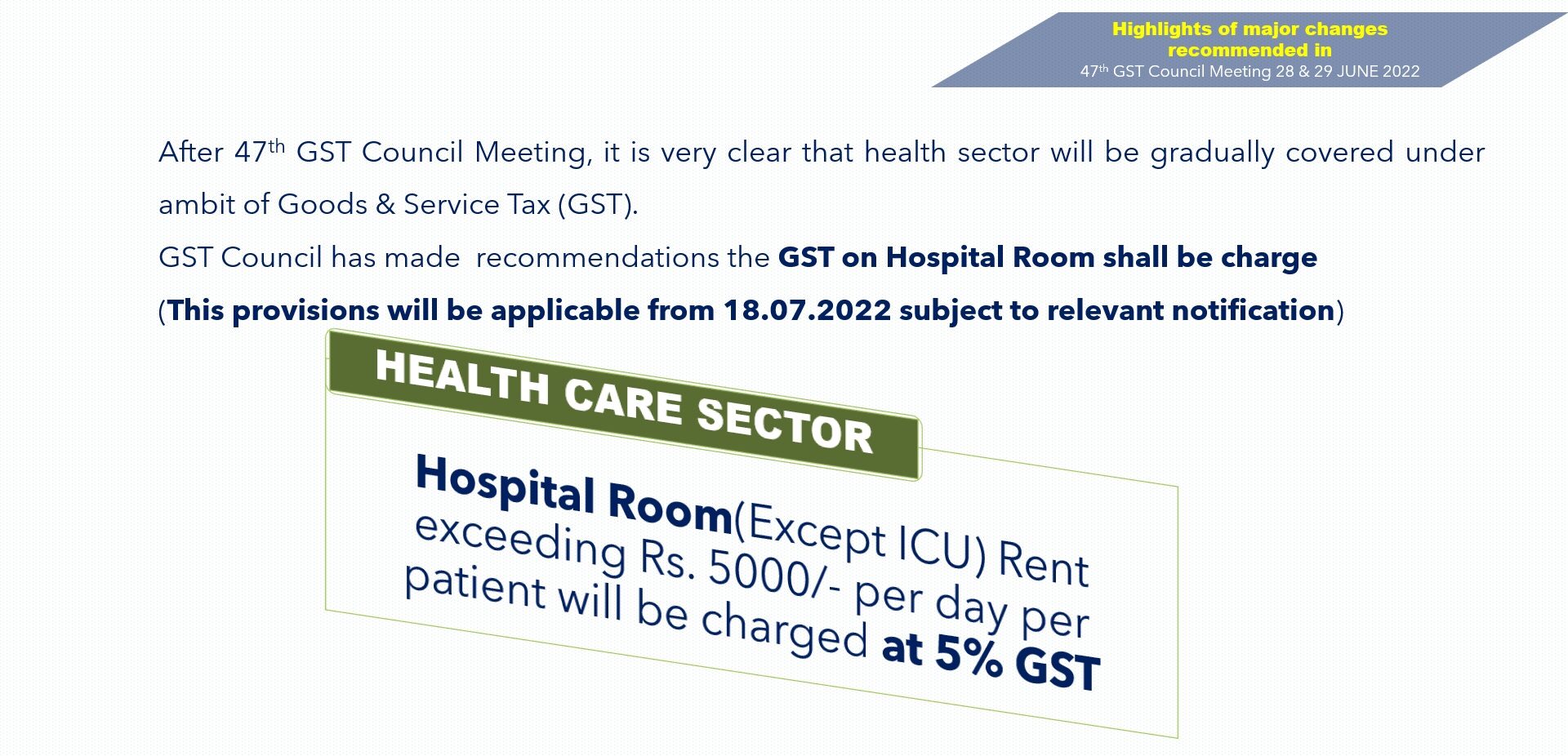

- Hotel Room of Rs. 1000/ day will be charged at 12% GST

- 5% GST will be applicable on Ice-cream sold by Ice-cream parlor (Clarification )

- Sale of Land after leveling & drainage facility will considered as Land, hence NO GST

DUE DATE EXTENSION & EXEMPTIONS

•Date extended for filing GSTR-4 of FY 2021-22 by 28.07.2022

•Date extended for filing CMP-08 for April to June 2022 quarter from 18.07.22 to 31.07.22

•NO NEED TO FILE GSTR-9 / 9A for FY 2021-22 whose aggregate turnover is upto Rs. 2 crore