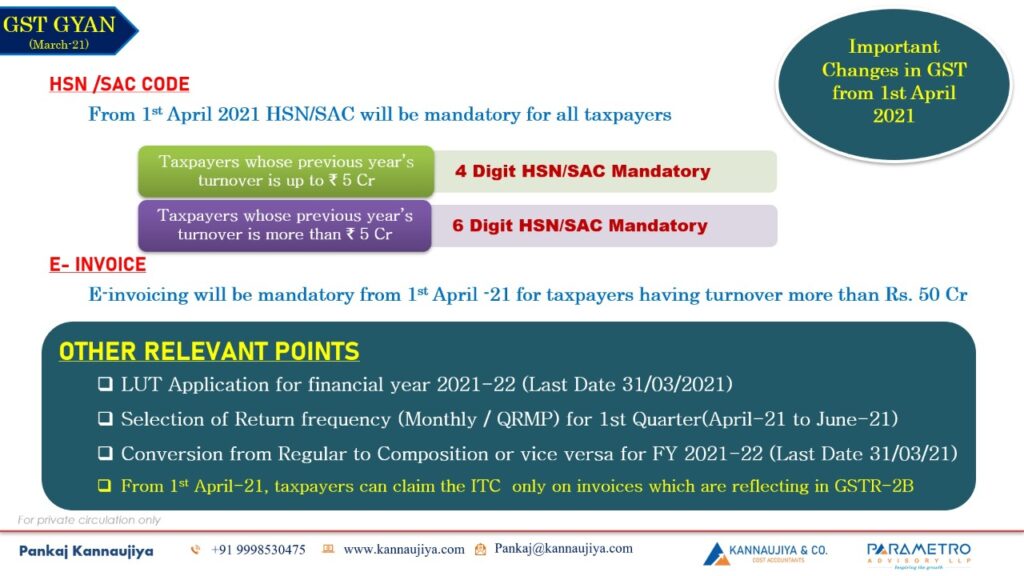

Important Changes in GST from 1st April 2021

HSN /SAC CODE

From 1st April 2021 HSN/SAC will be mandatory for all taxpayers

- Taxpayers whose previous year’s turnover is up to Rs. 5 Cr – 4 Digit HSN/SAC Mandatory

- Taxpayers whose previous year’s turnover is more than Rs. 5 Cr – 6 Digit HSN/SAC Mandatory

E- INVOICE

E-invoicing will be mandatory from 1st April -21 for taxpayers having turnover more than Rs. 50 Cr.

OTHER RELEVANT POINTS:

- LUT Application for financial year 2021-22 (Last Date 31/03/2021)

- Selection of Return frequency (Monthly / QRMP) for 1st Quarter(April-21 to June-21)

- Conversion from Regular to Composition or Composition to Regular for FY 2021-22

- From 1st April-21, taxpayers can claim the ITC only on invoices which are reflecting in GSTR-2B